Earn smarter

Save better

Traditional banking simplicity with Decentralized Finance level performance.

Bank savings: 2.25% – 3.5% annual yield

autoscale: 10 - 15% yield with daily compounding

Your savings, supercharged.

The DeFi platform as simple as online banking

Banking vs. DeFi

Who holds your money?

Defi

TradFi

• Users have full control over their assets via private wallets. No central authority can freeze or restrict access.

• Banks technically own deposited funds until withdrawal. Access can be restricted in case of crises, bankruptcy, or legal disputes

Financial freedom

• No entity can freeze or seize your assets. Even if a protocol fails, your funds remain under your control.

• Banks can freeze or seize accounts under specific conditions (e.g., economic sanctions, tax investigations, crisis driven withdrawal limits).

Savings return

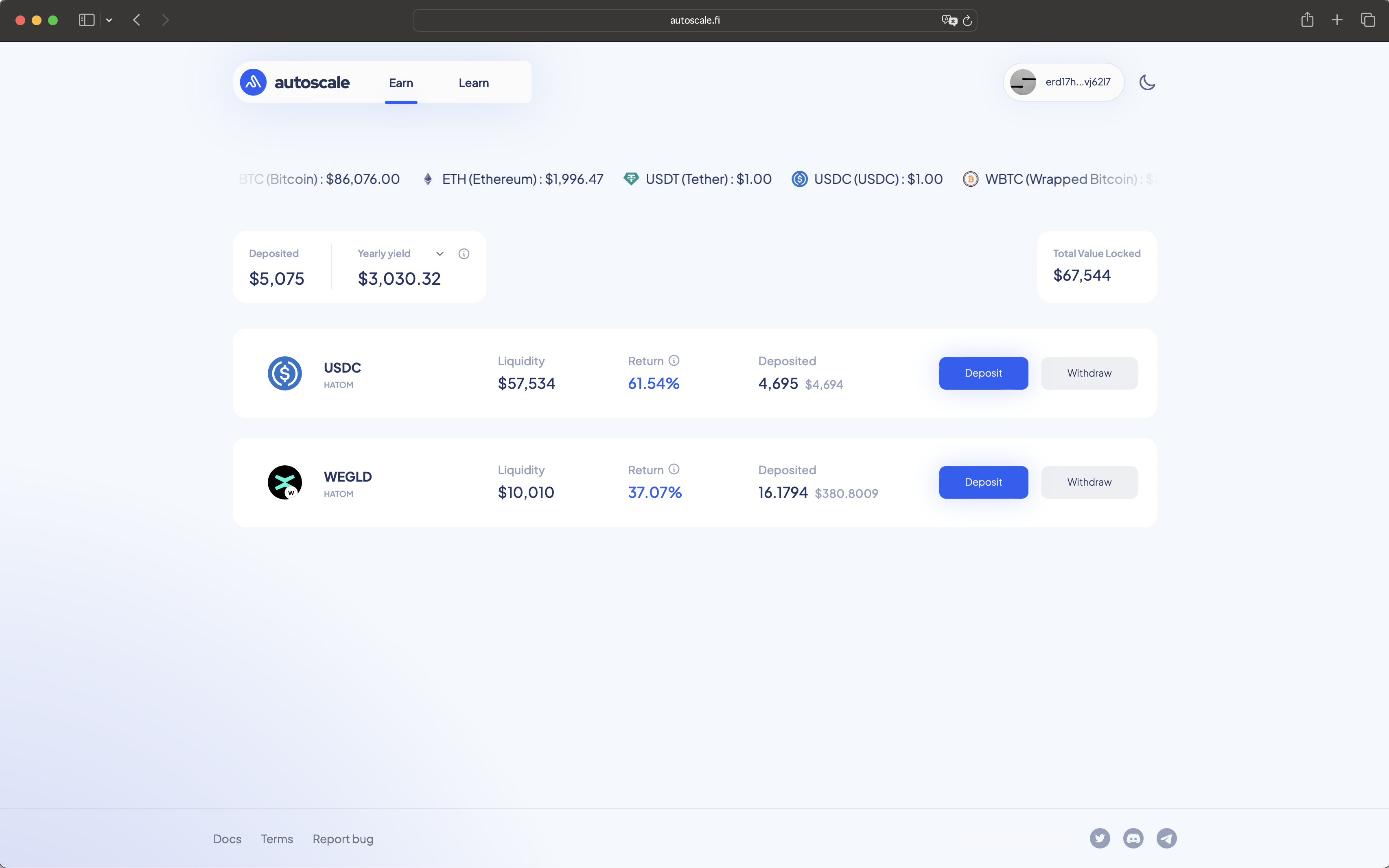

• Protocols like autoscale via Hatom offer 10-15% APY on stablecoins through automated strategies.

• In Europe, traditional savings accounts or bank accounts offer significantly lower returns (2.25%–4%).

Transparency

• Fully on-chain, real-time visibility. Audits are public, and transactions are immutably recorded on the blockchain.

• Banks and funds publish reports, but these are retrospective and often opaque (e.g., SVB’s 2023 collapse went unnoticed despite regulatory audits, just like the 2008 subprime crisis).

Availability

• 24/7 availability, transactions settle in seconds to minutes, depending on the blockchain.

• Limited to banking hours and business days. Transfers take 24 to 72 hours, longer for international transactions.

Risk & regulation

• Greater financial autonomy with some inherent risks, such as smart contract vulnerabilities and an evolving regulatory landscape.

• European banks claim to guarantee deposits up to €100,000, but past crises cast doubt on their ability to do so. Bank failures can trigger bail-ins or capital controls, restricting access to funds.

Roadmap

Phase 1 (Q1 2025): Laying the foundation

We are currently in the first phase, where we have successfully launched our devnet and are actively collecting user feedback to refine our platform. Our focus is on ensuring security and robustness. Alongside this, we are intensifying our communication strategy, fostering industry partnerships, and engaging with our community to build a solid foundation for adoption.

Phase 2 (Q2 2025): Expanding capabilities

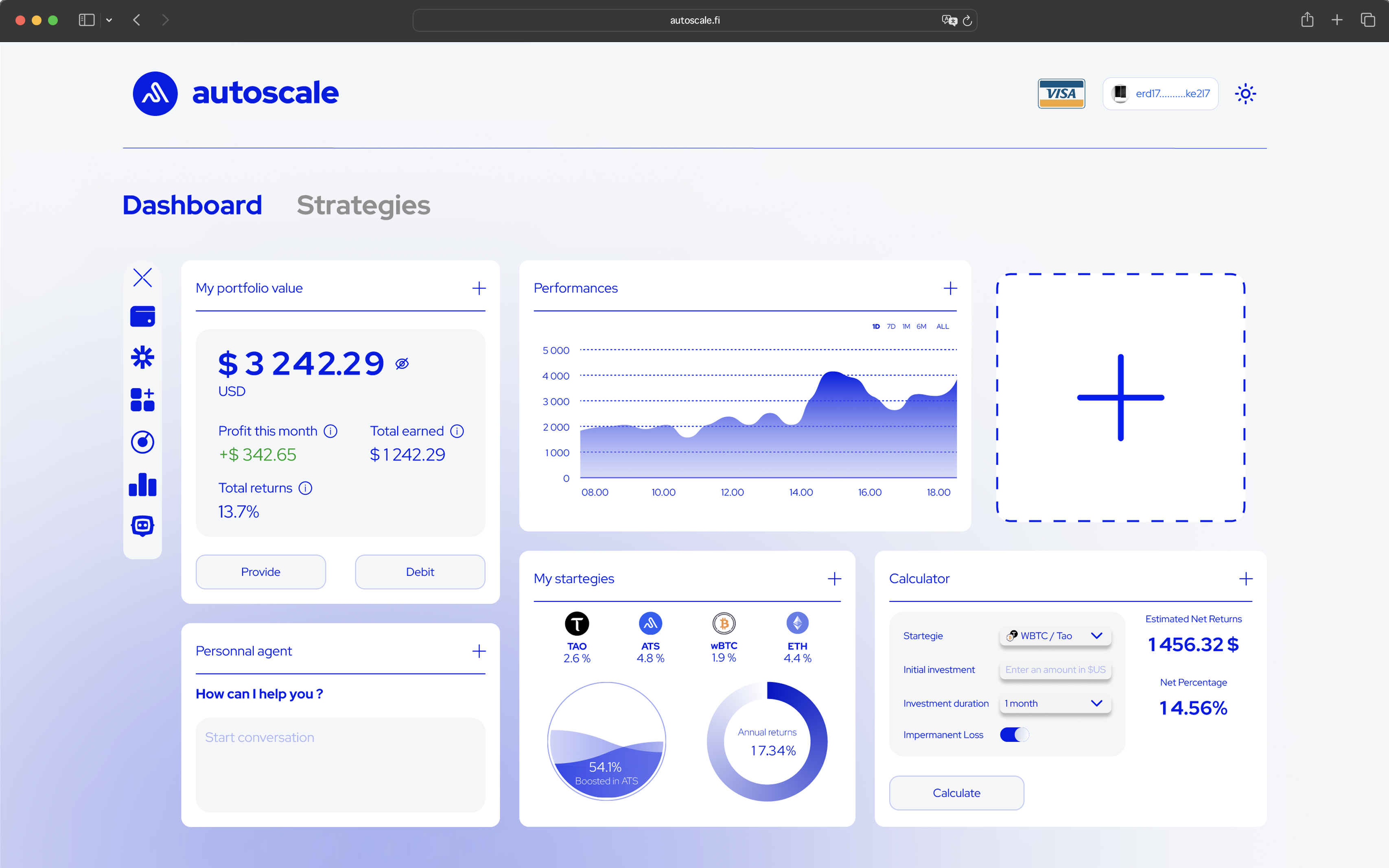

With the V2 launch, we will introduce advanced investment and savings strategies such as liquidity pools innovations, and automated compounding. This phase also marks the deployment of the ATS Booster, featuring native token integration and a bug bounty program to further strengthen security. Enhancing the user experience remains a priority, with intelligent dashboards, AI-powered insights, and DeFAI, a natural language interface simplifying DeFi interactions. Our presence within the industry will also grow through conferences and strategic events.

Phase 3 (Late 2025): Scaling and innovating

In the final phase, we will implement a cross-chain expansion strategy to maximize accessibility. Autonomous agent development will optimize yield on stablecoins with minimal fees, while our innovation lab will support cutting edge research by onboarding PhD candidates through grants. Finally, our focus on accessibility will be reinforced through an advanced user interface and API development, ensuring harmonious interaction for Web2 users and offering premium access features.